Prepaid debit cards are growing in popularity as a way for people to digitize their cash without a traditional bank account or credit card. With a prepaid card, you can load funds directly to your card and then shop securely in stores or online. This provides a convenient method of payment without risking overdrafts or incurring interest expenses.

Some prepaid debit cards even offer direct deposits. This means you can have your employer or government benefits office deposit your pay directly to your card. With direct deposits, you don’t have to wait to receive a paper check, find a check-cashing service, and manually load the cash onto your card. Your money is just there, ready to be used, sometimes up to a few days earlier than it would be transferred to a traditional bank account.

But how do you find the prepaid card with direct deposit that fits you? What should you look for? And which direct deposit cards are the best on the market?

Read on to get answers to all your questions about getting the best prepaid debit card for direct deposits.

What to look for in a prepaid debit card with direct deposit

When shopping for a direct deposit card, look for the following features:

- Reasonable fees. Some cards charge monthly fees, while others allow you to pay-as-you-go, charging per transaction instead. You might also pay for services like loading cash onto your card, pulling cash from an ATM, or using the card internationally. Some cards offer reduced monthly fees for customers who exceed a set amount of direct deposits in a given month, so arranging direct deposits can save you money on your prepaid card.

- Early access to your direct deposit funds. Some cards allow you to start spending your paycheck or government benefits as soon as the payment instructions come through, rather than waiting for payment settlement. This means you could get access to your money up to a day or two earlier.

- A widely accepted payment network. Cards that use the Visa or Mastercard networks are the most widely accepted. American Express (Amex) is another good option, but the Amex network isn’t quite as extensive.

- A large reload network. Even if you’re mostly using direct deposits to fund your card, you might need to deposit cash at some point (like if you’re paid cash for an odd job or given cash as a gift), so it’s a good idea to make sure your prepaid card is part of a large reload network (e.g., Netspend Reload Network1 or the Green Dot Network) that makes it easy to deposit cash.

- Account access. A reliable website or mobile app should let you check your balance, view transactions, set up direct deposit, and transfer funds.

- Security and fraud protection. Choose a card with account alerts to help you monitor transactions and EMV chip technology for added protection.

Prepaid debit cards with direct deposit

With fees, accessibility, convenience, and security in mind, here are the best direct deposit prepaid cards currently available.

Netspend® Prepaid Card

The Netspend® Prepaid Card2 is versatile, affordable, and widely accepted. You can choose between an affordable monthly payment plan3 or pay as you go3 through fees on individual purchases. Plus, if you have $500 or more in payroll and/or benefit direct deposits in a single month, you get a discount on your monthly card fees3 for that month. With Netspend, you can access your direct deposit funds up to two days faster4 than you would with a traditional bank account.

In addition to easy direct deposit setup via the website or mobile app, the Netspend Reload Network includes over 130,000 retail locations1 nationwide where you can add cash to your card.

- Direct deposit fee: $0

- Monthly fee3: $0 for the pay-as-you-go plan, $9.95 for the monthly plan (reduced to $5.00 when you have at least $500 loaded to the card through direct deposit during the previous month)

- Cash reload fee: Up to $3.95, depending on the reload location

- Purchase transaction fee3: $0 with the monthly plan, $1.95 with the pay-as-you-go plan

- ATM withdrawal fee: $2.95

- Cost to purchase the card: $0 when purchased online, up to $9.95 when purchased in-store

- Activation fee: $0

Fees as of July 5, 2025, according to Netspend’s Prepaid Account Agreement.

Green Dot Prepaid Debit Card

The Green Dot Prepaid Debit Card promotes early direct deposits of up to two days for payroll deposits or four days for government benefits (only for employers or government agencies who issue the payment instructions early enough). The Green Dot Network also makes it easy to load cash onto your card.

If you load $1,000 or more to the card in a given month, the monthly card fee is waived for that month. These loaded funds can come from direct deposits, cash reloads, or bank transfers, but person-to-person transfers don’t count toward this $1,000 minimum.

- Direct deposit fee: $0

- Monthly fee: $7.95 (waived when you load $1,000 or more to your card during the previous month via any reload method except person-to-person transfers)

- Cash reload fee: Up to $5.95, depending on the reload location

- Purchase transaction fee: $0

- ATM withdrawal fee: $3.00

- Cost to purchase the card: Up to $1.95, whether purchased online or in-store

- Activation fee: $0

Fees as of July 5, 2025, according to Green Dot’s Cardholder Agreement.

Serve Free Reloads Card

The Serve Free Reloads Card is ideal for cash reloads at retail locations because many providers are included in Serve’s Free Reloads network. But this card is also well-suited to direct deposits with no direct deposit fees and access to direct deposit funds up to two days early.

- Direct deposit fee: $0

- Monthly fee: $9.95

- Cash reload fee: $0 at participating retailers, up to $3.95 at other locations

- Purchase transaction fee: $0

- ATM withdrawal fee: $0 for ATMs in the MoneyPass network, $2.50 for out-of-network ATMs

- Cost to purchase the card: $0 when purchased online, up to $2.00 when purchased in-store

- Activation fee: $0

Fees as of July 5, 2025, according to Serve’s Fees Page.

Bluebird Prepaid Debit Card

The Bluebird Prepaid Debit Card is among the most affordable direct deposit prepaid cards available, with no monthly fees or direct deposit fees. This is one of the very few cards with free reloads, although its free reloads only apply to Family Dollar locations.

One potential downside to be aware of is that Bluebird issues American Express (Amex) cards, which have a smaller payment network that includes fewer merchants than Visa or Mastercard. Before ordering this low-fee prepaid card, consider whether the places you regularly shop accept Amex.

- Direct deposit fee: $0

- Monthly fee: $0

- Cash reload fee: $0 at Family Dollar, up to $3.95 at other locations

- Purchase transaction fee: $0

- ATM withdrawal fee: $0 for ATMs in the MoneyPass network, $2.50 for out-of-network ATMs

- Cost to purchase the card: $0 online or $5 at Walmart

- Activation fee: $0

Fees as of July 5, 2025, according to the Bluebird Agreement.

Walmart MoneyCard

If you regularly shop at Walmart, the Walmart MoneyCard might be a good fit for you. In addition to free direct deposits and free cash reloads at Walmart locations when you use the app to generate a scannable code, the monthly fee for this card is waived when you have at least $500 loaded to the card through direct deposit during the previous month. And the card includes early payday, which makes your money available up to two days before payday and up to four days before benefits day.

The Walmart MoneyCard also offers cash-back opportunities. You can earn 3% cash back at Walmart.com, 2% back at Walmart fuel stations, and 1% back at Walmart stores, up to $75 per year.

- Direct deposit fee: $0

- Monthly fee: $5.94 (waived when you have at least $500 loaded to the card through direct deposit during the previous month)

- Cash reload fee: $3.00 at Walmart registers (free when using the app to create a scannable code for the Walmart cashier) and up to $5.95 at other locations

- Purchase transaction fee: $0

- ATM withdrawal fee: $0 at Walmart ATMs, $2.50 at non-Walmart ATMs

- Cost to purchase the card: $1.00, whether purchased online or in-store

- Activation fee: $0

Fees as of July 5, 2025, according to Walmart’s Fee Plan.

How to choose the best direct deposit prepaid card for you

The best prepaid card for direct deposits depends on your needs and how you plan to use the card. For example:

- If you’re looking for a balance of flexibility, convenience, and affordability, Netspend is a well-rounded card that offers a wide range of features and the largest cash-reload network, with the option to pay as you go or pay a monthly rate (which is deeply discounted if you deposit over $500 in a given month).

- If you’re looking for the lowest-cost option, Bluebird has no monthly service fee, even if your direct deposits are under $500 per month.

- If you’re planning to consistently have a substantial amount of money direct deposited, Green Dot offers robust features and waives the monthly fee for those who deposit over $1,000 in a given month.

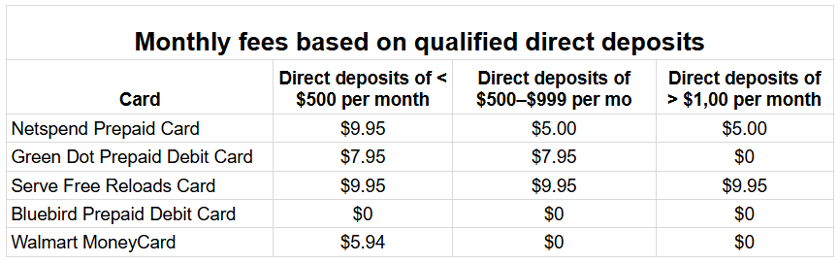

Comparison of fees for prepaid cards with direct deposit

Here is a chart comparing monthly fees for each card, based on how much you direct deposit in a given month.

Using monthly fees as the primary basis for choosing the best prepaid card for direct deposits, the Bluebird card is best for those with direct deposits of less than $500 per month, the Walmart MoneyCard is best for those with at least $500 per month, and the Green Dot card is best for those with over $1,000 per month.

Choosing the prepaid debit card with direct deposit that suits you

Prepaid debit cards with direct deposit offer a convenient, secure, and bank-free way to manage your money, but some cards work better than others for direct deposits.

The options on this list of the best prepaid cards for direct deposits all offer reasonable fees, early access to direct deposit funds, user-friendly online/app management of your card, and cash reload options for times when you want to supplement your direct deposits with cash infusions.

When choosing the right card for you, consider how much you plan to direct deposit each month, the cost of the card, and alternative reload options. When you’re ready, order your card and set up direct deposits to streamline your finances.