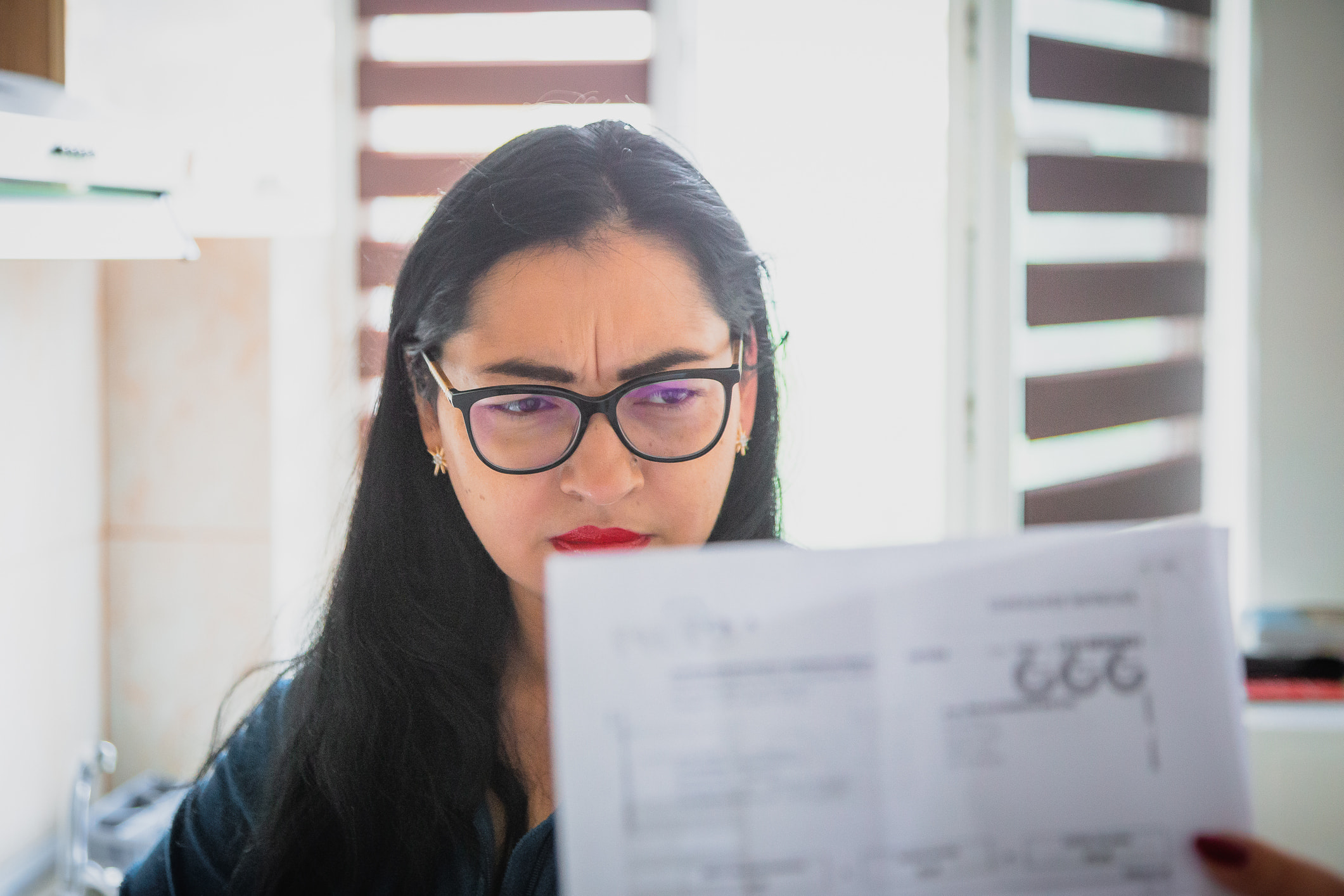

You've worked hard all week for your paycheck, but when you get it, it's less than expected. You may even find it's not enough to pay important bills like your rent or student loans.

Why does this confusion happen? One of the reasons could be understanding the difference between gross pay and net pay, an important distinction that can impact your financial planning.

Read on to learn more about both net pay and gross pay, how they work, and what you can do to ensure you get paid correctly. Knowing these things can help you budget, make short- and long-term financial plans, and get the ultimate answers you need to the question: "Why is my paycheck so low?"

What is net pay?

Net pay is the amount of money left on your check after certain deductions are taken out. This amount is also often called "take-home" pay, and it's what actually gets deposited into your bank account or onto your debit card.

It differs from gross pay, or the total amount you earn from working, which includes all wages, salaries, overtime, bonuses, commissions, and other forms of compensation earned during a pay period.

For salaried employees, gross pay is typically the annual salary divided by the number of pay periods.

For hourly employees, gross pay is calculated by multiplying the hourly wage by the number of hours worked, plus any overtime or additional earnings.

Here is the formula comparing net pay and gross pay:

Net Pay = Gross Pay − Total Deductions

For example, let's say you earn $14 an hour and work 40 hours a week. You might expect to get $560 on your weekly paycheck. The $560 is the gross amount of pay.

After certain deductions, you only get a $455 deposit into your bank account. This $455 is net pay and what you'll need to budget for to live on. As you can see, there's a big difference between net vs. gross pay.

Common payroll deductions

Payroll deductions are amounts taken from your gross pay to help cover certain expenses, such as taxes, insurance, or retirement plans. Here's a breakdown of common examples, along with how they work.

Federal income tax

These are based on the withholding you indicated on a Form W-4 with your employer. The exact amount taken out depends on your income and tax filing status and gets reconciled when you file your federal tax return each year.

State and local income taxes

These funds pay for local services, such as schools or roads. It's based on your state or local laws. Some states, like South Dakota and Florida, don't have state income tax, so nothing would be taken out for this if you live in one of those states.

Social Security tax

This paycheck withholding pays for retirement, disability, and survivor benefits through the Social Security program. It's 6.2% of a paycheck, with your employer paying the other 6.2% to make the full 12.4% required.

Medicare tax

This tax funds health care for those 65 and older and certain disabled individuals. It's 1.45% of your income (with your employer paying an additional 1.45% to make the full 2.9%). Single filers earning more than $200,000 pay an additional 0.9% of their income over $200,000. So the first $200,000 is taxed at 1.45% and anything above $200,000 is taxed at 0.9%.

Wage garnishments

If you were ordered by the court to pay child support, alimony, or past debts, these may be taken from your paycheck as a garnishment. The court requires your employer to take out this money, and the amount will vary depending on what you owe and the agreement made with the courts.

Health insurance premiums

If you get health coverage through your work, the premium payments will likely come out of your paycheck. This deduction may come out before taxes, reducing your total taxable income. These premiums may include payments for health, dental, or vision care.

Retirement contributions

Whether you add to a 401(k), 403(b), or another employer-administered retirement plan, expect your contributions to come out of your paycheck before you get it. These can be pre-tax, meaning they lower your taxable income, and employers may also match your contributions. So, a $100 contribution decreases your paycheck, but your employer may also add its own money to your retirement account.

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA)

These are two ways to put away money for certain medical expenses, such as medical treatment, OTC medications, and some medical supplies. When you add money to these accounts, they reduce your taxable income and ensure you have some money when you need it for medical costs. HSA money you don't use in a given year can roll over to the next, while unused FSA funds don't. Both account contributions will reduce your net pay.

Dependent Care FSA

Similar to how a medical care FSA lets you set aside pre-tax money for health supplies, the dependent care FSA lets you do the same for childcare expenses. When the money is taken from your check, it gets put into an account that you can use to pay for daycare or an eligible child care service. They can reduce your taxable income.

Life and disability insurance premiums

Some employers offer these insurances through the workplace, making it easier to get coverage to help your loved ones financially if you pass away. Premiums usually come out after your taxes, and the amount will reduce your take-home pay.

Charitable contributions

If you want to support a charity, you may be able to have your donation taken directly from your paycheck. It reduces the need to write a separate check or make a credit card payment, and it may be easier to track how much you've paid to charity come tax time. This donation amount will reduce your net pay.

Union dues

Labor union members often pay membership dues to get benefits and additional support from the union. These fees get taken out after taxes, and they can make your paycheck smaller. Union dues may include those for skilled trades like electricians or builders, as well as those for teachers and actors.

Why your paycheck might be lower than expected

If you look at your paycheck and it seems too low, you may have forgotten about one of the deductions mentioned above. It's also possible that you didn't realize the total cost of a deduction, such as a new health insurance plan with a higher cost than the plan you had the year before.

Other reasons include the following:

- Changes in tax withholding. If you made an update to your W-4 (such as claiming fewer dependents), it could increase the amount of taxes taken out.

- Payroll errors or administrative issues. Employers do make mistakes, and it's possible that your check shouldn't have been so small. If they calculated your rate incorrectly or didn't track your hours well, you could be missing wages from your check.

- Prorated pay. Depending on when you started a new job, you may not have worked long enough for a full pay period. This means your check only covers a portion of the period, and you'll get the rest on the following check.

- Missed payment deadlines. Some extra pay, like bonuses or raises, may have gone into effect just after the cut-off date for this check's processing. Give it some time to make sure it appears on the next check.

- Earned wage access repayment. If your employer offers earned wage access, you can borrow money from a paycheck before your typical payday. This money then won't be available on your check and can make your check seem smaller by comparison.

What to do if your net pay seems wrong

If your check is not what you expected, take the following steps.

- Review your paystub carefully. Look at each line, so you understand what each deduction means.

- Adjust your W-4 if necessary. You may have the wrong number of deductions, making your check too small. Fix this to get your money now instead of at tax refund time.

- Track your hours. This is important so you know you get paid for every hour you work.

If you still think your check is too small, reach out to HR or your payroll department with any questions. They can walk you through the numbers on your paycheck and fix any mistakes that come up.

How to use net pay for planning

After you've received a paycheck and fully understand what's been taken out, you can better plan for the future. You can know what your net pay will be next time and use that number to create a budget. It will also be helpful to track over time, so you know how much you've paid in state and federal income taxes. These totals can help you prepare for tax season and can even help you calculate the size of your tax refund.

Even if your net pay isn't quite the number you expected, it's important to know. This number may change over time, but its purpose remains the same.