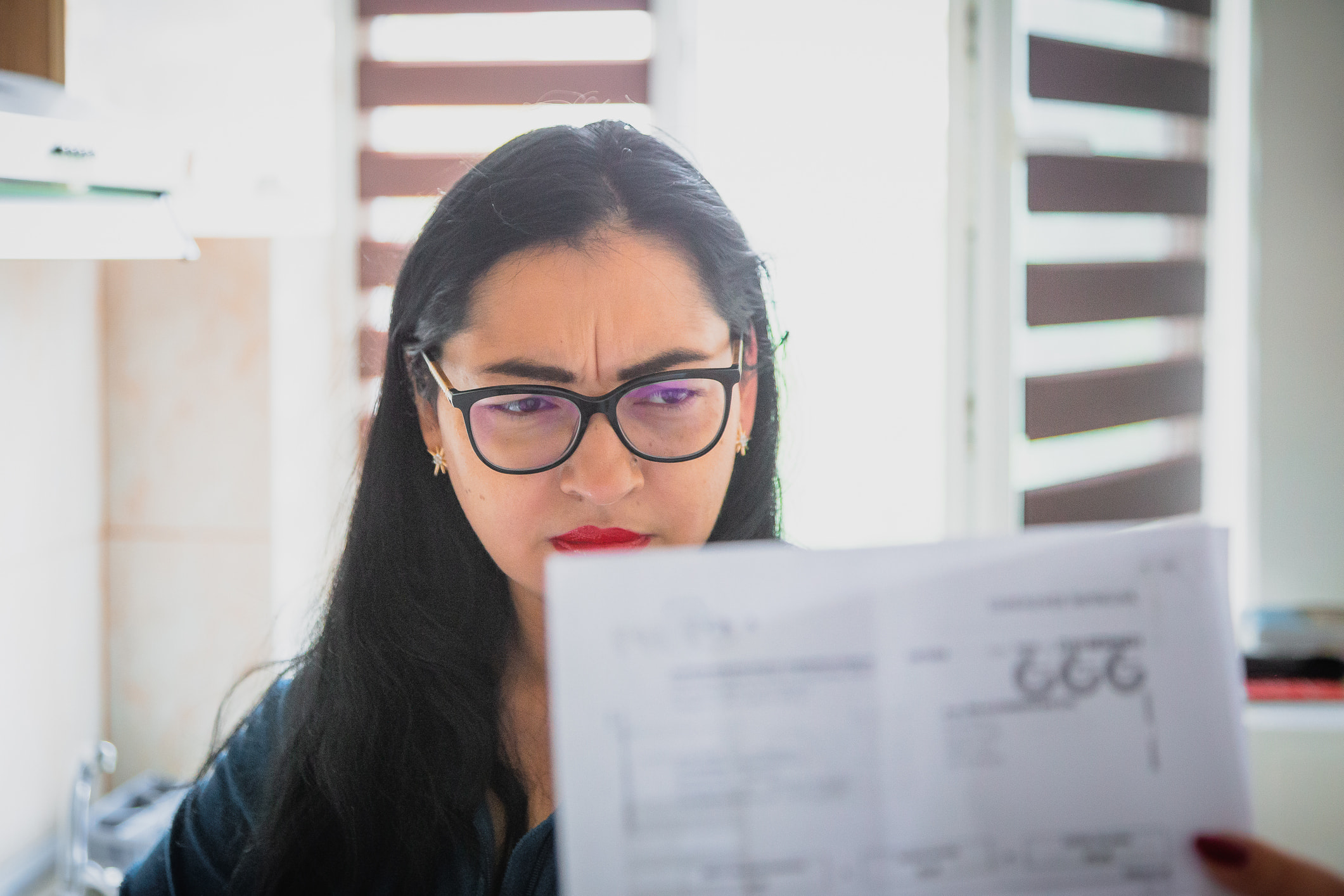

Even if you have a professional do your taxes, it's a smart move to become familiar with all of the paperwork needed to file a proper tax return. One of the forms that may be new to you this year is a 1099-MISC. A common tax form for self-employed workers, a 1099-MISC is an essential measure of your income for the year. Here's what you should know about the 1099-MISC tax form before you file your tax returns.

What is 1099-MISC, and why did I receive it?

If you've ever had a job, you may be familiar with getting a form at the end of each year with a total of your income paid and taxes withheld. For a traditional employee, this income is reported on a W-2. For a self-employed worker, this information is reported on a 1099-MISC. It will show monies paid over the previous tax year and give you important information needed to calculate your taxable income.

What determines whether you get the 1099-MISC or a W-2? Your relationship with the company or employer is the deciding factor. For example, if you own your own business as a freelance writer, you will likely receive a 1099-MISC from each of your clients. However, if you're a staff writer at a newspaper, your reported income will likely show up on a W-2 from your employer.

You were most likely informed of your classification when you started working with the person, client, or company who is now issuing you these forms.

Examples of work that may receive a 1099-MISC include:

- Delivery or ride-share drivers hired through an app

- Dog sitters or babysitters

- Actors, artists, and photographers

1099-MISC instructions

Whether you file your own taxes or not, you should always verify the information reported on a 1099-MISC tax form. If you discover an error, you should inform the person, client or business that issued it to you and request a correction.

- If you are expecting a 1099-MISC form and don’t receive it, call the client or business that you expected to receive one from. If they don't respond or fail to provide that info before it's time to file your taxes, you may need to use your own records to figure out how much they paid you that tax year.

It is a suggested best practice to keep copies of these forms for at least seven years. They are an important record of your business.

Helpful tax preparation resources

For information on how to pay taxes as a freelancer and how to report self-employment income, check out these resources:

If you have questions about preparing your taxes, both at the federal or state level, it's best to consult a tax professional.

Whether this is your first year receiving a 1099-MISC or your fifth, it's easier for some people to have their tax refund put on a Netspend Small Business Prepaid Mastercard. Doing this will help keep your business expenses separate from your personal expenses, helping you to be more organized. The Netspend Small Business Account can help you keep your business-related purchases under control and potentially provide a handy record of business expenses for next year at tax time.